Ways to Give

There are many ways to give, including outright gifts of cash, property or securities, gifts from a retirement account, gifts which provide lifetime income to you, bequests, or employer matching contributions. Find the type of gift that works best for you which matches your personal budget or long-term financial plan.

Gifts of Cash

Your gift matters and we are here to assist you in achieving your personal philanthropy goals.

Cash gifts are the easiest to give and the easiest for us to use. They don’t have to be actual cash, of course. Checks, debit or credit cards are the most common ways people donate. (Checks can be made payable to Santa Rosa Memorial Foundation.) You can also set up a monthly contribution that can be automatically charged to a card or account of your choice.

Planned Giving

Caregiver Giving

Tax ID & Mailing Address

Al and Helen Maggini Legacy Society

The Al and Helen Maggini Legacy Society celebrates the significant contributions of Al and Helen Maggini to Providence’s mission of enhancing health and quality of life in our community. Al was a founding member of our Foundation in 1991. Throughout his life, Al provided trusted, wise advice about how best to meet the needs of our community.

Legacy donors who make a planned gift to support Santa Rosa Memorial Hospital are honored by being inducted into the Al and Helen Maggini Legacy Society. Their names are displayed on a recognition board located in the main lobby of the hospital. Additionally, these generous benefactors are invited to an annual luncheon that celebrates and acknowledges their commitment and support.

IRA Charitable Rollover

The IRA Charitable Rollover is now a permanent provision of the federal tax code. It allows donors who are age 70 ½ or older to donate up to $100,000 each year from their IRA. The contribution counts towards your Required Minimum Distribution yet it is not included in your income. A gift from your IRA provides an excellent opportunity to make a gift during your lifetime from an asset that is often subject to multiple layers of taxation if left in your estate.

Transfers must be made directly from a traditional IRA account by your IRA plan administrator. Gifts from 401 (k), 403 (b), SEP or other plans do not qualify for this provision. Contact your plan administrator to initiate.

Other Ways to Give

Gift of Securities

Unique Gifts

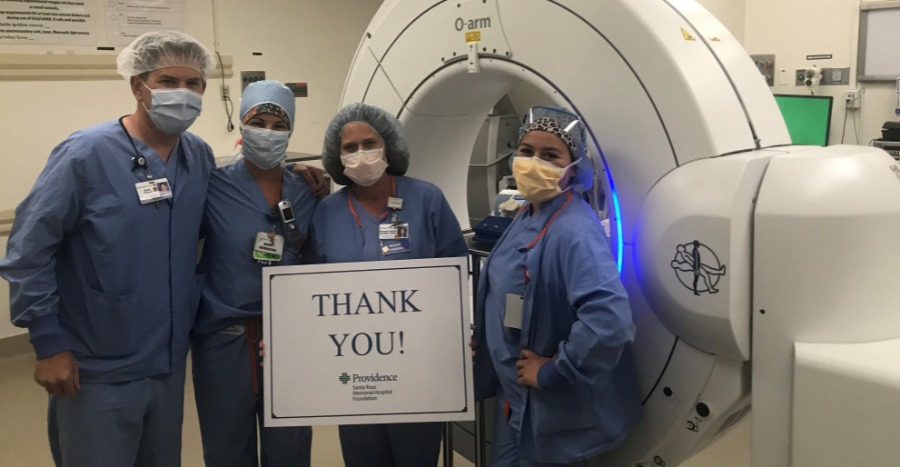

SUPPORT OUR WORK

Now, more than ever, our community needs Providence Santa Rosa Memorial Hospital and compassionate neighbors like you.

Share